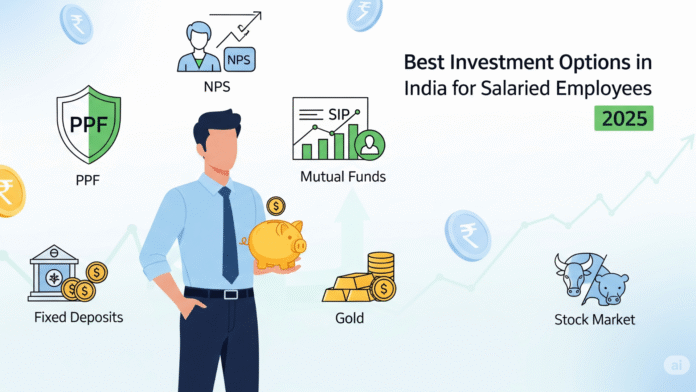

Financial planning is one of the most important aspects of a salaried employee’s life. With fixed monthly income and rising expenses, it becomes crucial to invest money wisely to achieve both short-term and long-term goals. In 2025, there are several investment options available in India that can help salaried individuals grow their wealth, save taxes, and secure their future.

In this detailed guide, we will explore the best investment options in India for salaried employees in 2025, their benefits, risks, expected returns, and suitability based on financial goals.

Why Should Salaried Employees Invest?

Most salaried employees depend on a fixed monthly income. Without proper investments, this income may not be enough to:

Beat inflation

Save for retirement

Manage emergencies

Build wealth for future needs (like children’s education, marriage, or buying a home)

Therefore, choosing the right investment avenue is the first step towards financial freedom.

- Employee Provident Fund (EPF)

Type: Government-backed retirement savings scheme

Return Rate (2025): Around 8% (subject to government updates)

Tax Benefits: Contributions qualify under Section 80C (up to ₹1.5 lakh)

Best For: Long-term retirement planning

Why It’s Good: EPF is a safe and stable investment for salaried employees as both employer and employee contribute. The interest is tax-free, making it a great wealth-building tool.

- Public Provident Fund (PPF)

Type: Long-term savings scheme

Return Rate (2025): Around 7.1% (government-backed)

Lock-in Period: 15 years (partial withdrawals allowed)

Tax Benefits: 80C deduction + tax-free interest

Why It’s Good: Ideal for risk-averse salaried employees who want guaranteed returns and tax savings. It also helps in creating a retirement corpus.

- National Pension System (NPS)

Type: Government-sponsored pension scheme

Expected Returns (2025): 8–10% annually (market-linked)

Tax Benefits: Deduction under 80CCD (1B) up to ₹50,000 in addition to 80C

Best For: Retirement planning

Why It’s Good: NPS provides exposure to equities, government bonds, and corporate debt. It is one of the most efficient ways for salaried employees to plan their retirement.

- Mutual Funds (SIP)

Type: Market-linked investment

Expected Returns (2025): 10–15% (depending on fund type)

Best For: Wealth creation, medium to long-term goals

Taxation: Equity funds attract 10% LTCG tax after ₹1 lakh per year

Why It’s Good: Systematic Investment Plans (SIP) allow salaried employees to invest a fixed amount monthly. This disciplined approach builds wealth over time and provides higher returns than fixed deposits.

- Fixed Deposits (FDs)

Type: Bank investment

Return Rate (2025): 6–7.5%

Lock-in: Flexible (from 7 days to 10 years)

Risk: Low

Why It’s Good: FDs remain a safe choice for conservative investors. However, in 2025, due to inflation and taxes, the real return may be lower compared to mutual funds.

- Real Estate Investment

Type: Tangible asset investment

Expected Returns (2025): 8–12% (depending on location and property type)

Best For: Long-term wealth creation

Why It’s Good: Real estate remains a popular investment for salaried employees looking to build long-term assets. With the rise of REITs (Real Estate Investment Trusts), employees can also invest in property without buying physical real estate.

- Gold Investments (Digital Gold, ETFs, Sovereign Gold Bonds)

Return Rate (2025): 6–8% (market-driven)

Tax Benefits: Sovereign Gold Bonds offer additional interest + capital gains exemption after maturity

Best For: Diversification and inflation hedge

Why It’s Good: Gold is a traditional safe haven and helps diversify an investment portfolio.

- Stock Market (Direct Equity)

Return Rate (2025): 12–18% (high risk, high return)

Best For: Experienced investors with long-term vision

Risk: High volatility

Why It’s Good: Direct stock investment is suitable for salaried employees who understand market dynamics. It offers the highest return potential but also involves significant risks.

- Insurance + Investment Plans (ULIPs)

Type: Hybrid (insurance + investment)

Returns (2025): 8–12% (market-linked)

Lock-in Period: 5 years minimum

Best For: People looking for both insurance and investment

Why It’s Good: ULIPs provide life cover along with investment growth, but charges may be higher compared to pure mutual funds.

- Recurring Deposits (RDs)

Type: Bank deposit

Return Rate (2025): 6–7%

Best For: Small savers with fixed monthly income

Why It’s Good: RDs help salaried employees cultivate a disciplined saving habit with low risk.

How to Choose the Best Investment Option?

When selecting an investment option, salaried employees should consider:

Risk Appetite: Conservative investors can opt for EPF, PPF, and FDs, while aggressive investors may prefer mutual funds or equities.

Financial Goals: Retirement planning, child’s education, buying a house, or short-term savings.

Liquidity Needs: Investments like FDs and RDs are more liquid compared to PPF or real estate.

Tax Benefits: Choosing tax-saving instruments under Section 80C, 80CCD, etc.

Sample Investment Strategy for Salaried Employees in 2025

EPF/PPF/NPS: 30% (Retirement savings)

Mutual Funds SIP: 30% (Wealth creation)

FDs/RDs: 15% (Safe investments)

Gold/REITs: 10% (Diversification)

Stocks: 15% (High growth potential)

Conclusion

For salaried employees in 2025, the best investment options include a mix of safe instruments like EPF, PPF, and FDs, and growth-oriented options like mutual funds and equities. A diversified portfolio will not only provide safety but also generate wealth for the future

Reed more